42 call option payoff diagram

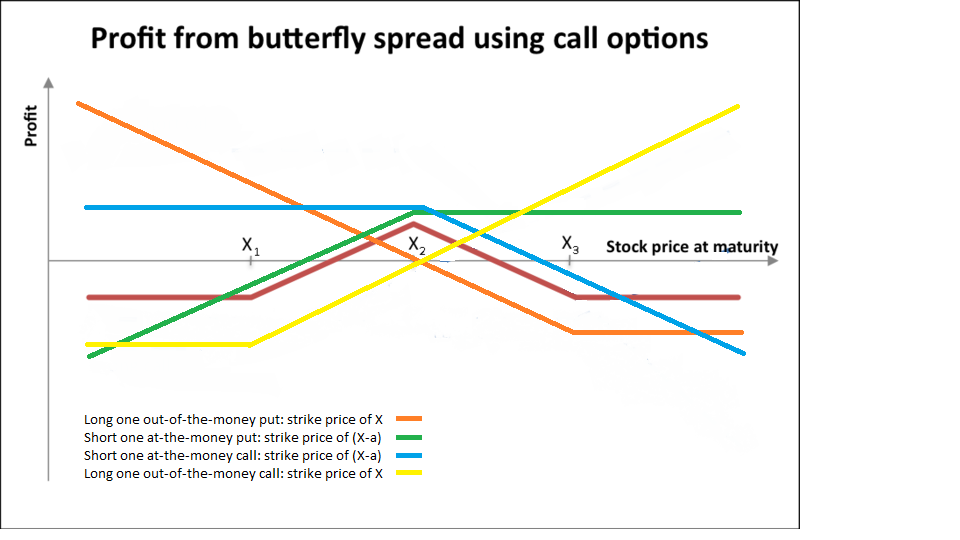

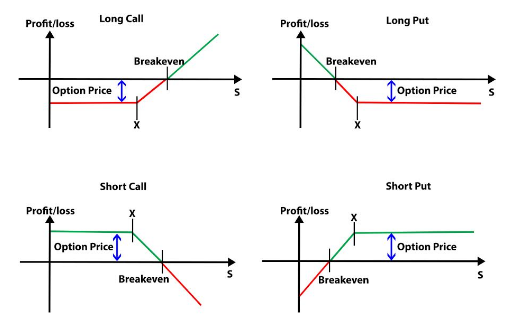

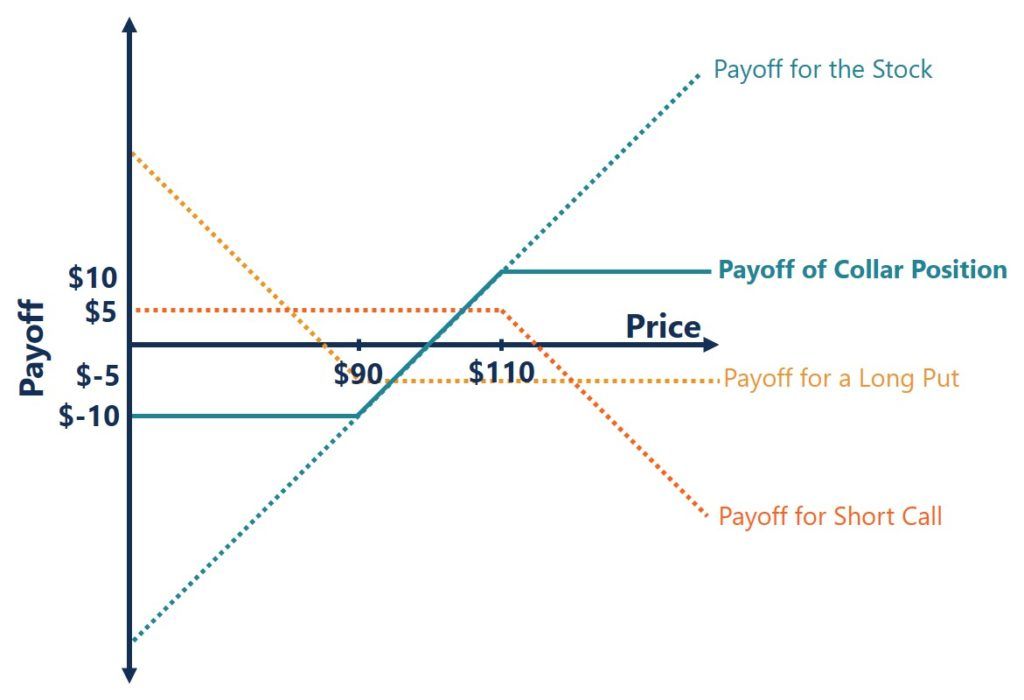

CHAPTER 21 . OPTIONS C. Determinants of Call Value. D. Black-Scholes Option Pricing Model (1973, BSOPM). E. Put-Call Parity. III. EXERCISE FOR PAYOFF DIAGRAM.17 pages Options Strategy Payoff Calculator Excel Sheet Looking at a payoff diagram for a strategy, we get a clear picture of how the strategy may perform at various expiry prices. By seeing the payoff diagram of a call option, we can understand at a glance that if the price of underlying on expiry is lower than the strike price, the call options holders will lose money equal to the premium paid, but if the underlying asset price is more than the ...

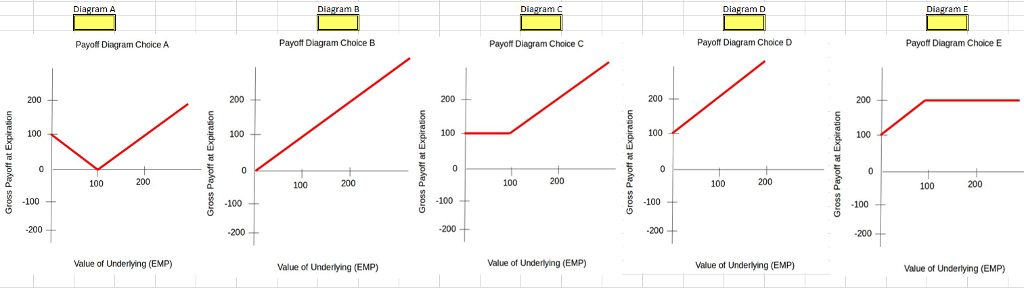

Call and Put Payoff Diagrams - Alison Payoff diagrams are a way of depicting what option or set of options or options combined with other securities are worth at option expiration. What you do is plot it based on the value on the underlying stock price, and I have two different plots here.

Call option payoff diagram

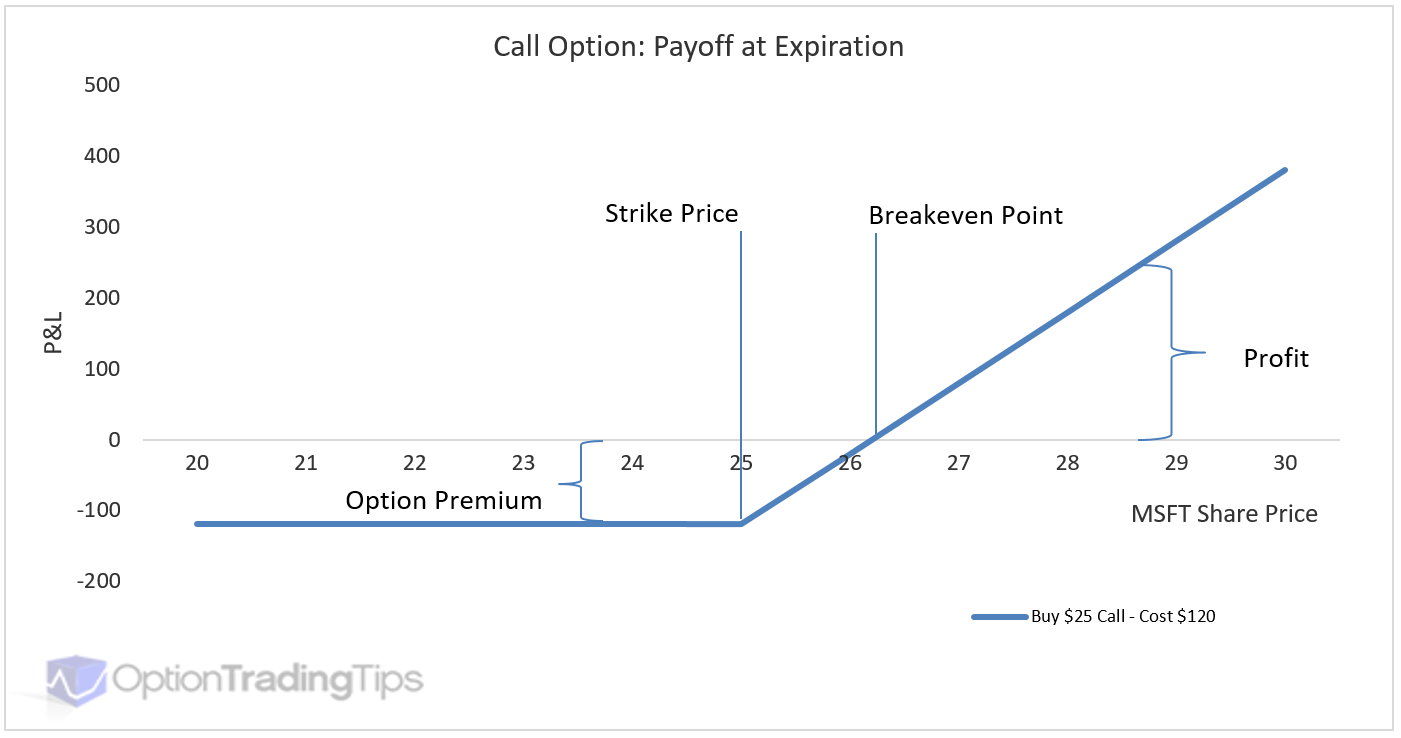

Call Option Payoff Graph - Options Trading IQ Call Option Payoff Graph Understanding payoff graphs (or diagrams as they are sometimes referred) is absolutely essential for option traders. A payoff graph will show the option position's total profit or loss (Y-axis) depending on the underlying price (x-axis). Here is an example: Option Payoff Diagram Excel - Wiring Diagrams 1, Payoff Diagram on a Call Option. 2, Current Stock Price = $ 3, Strike Price of Option = $ 4, Price of the Option = $ 5. 6, Stock Price, Gross. Call Option Payoff Diagram, Formula and Logic - Macroption Call Option Payoff Diagram Buying a call option is the simplest of option trades. A call option gives you the right, but not obligation, to buy the underlying security at the given strike price. Therefore a call option's intrinsic value or payoff at expiration depends on where the underlying price is relative to the call option's strike price.

Call option payoff diagram. Profits from Buying a Call Option: Payoff Diagram 👍 - YouTube Call Option payoff diagrams. PLEASE LIKE AND SHARE THIS VIDEO SO WE CAN DO MORE! Options trading can be very prof... Options payoff diagram worked example - Australian ... Net Payoff from the Call Options the payoff diagram). Basic Options Strategies with Examples . 1. Profit from stock price gains with limited risk and lower cost than buying the stock outright. Basic Options Charts: The blue line represents the payoff of the call option. it will be that far below the payoff line. Visualizing Option Trading Strategies in Python | by ... If no arguments are provided, payoff diagram for a long call option will be generated with strike price as $102 and spot price $100. Note that the trader's profit is shown in green shade and loss is shown in red. The call option buyer's loss is limited to $2 regardless of how low the share price falls. Call payoff diagram (video) - Khan Academy A call payoff diagram is a way of visualizing the value of a call option at expiration based on the value of the underlying stock. Learn how to create and interpret call payoff diagrams in this video. Created by Sal Khan. Google Classroom Facebook Twitter Email Sort by: Tips & Thanks Video transcript

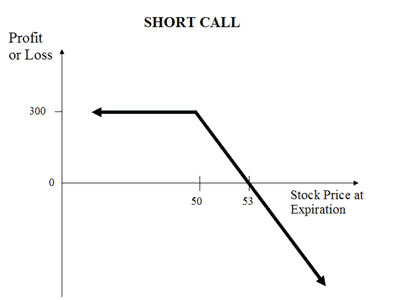

Calculating Call and Put Option Payoff in Excel - Macroption This is the first part of the Option Payoff Excel Tutorial.In this part we will learn how to calculate single option (call or put) profit or loss for a given underlying price.This is the basic building block that will allow us to calculate profit or loss for positions composed of multiple options, draw payoff diagrams in Excel, and calculate risk-reward ratios and break-even points. Covered Call Option Payoff Graph - Options Trading IQ Covered Call Option Payoff Graph Understanding payoff graphs (or diagrams as they are sometimes referred) is absolutely essential for option traders. A payoff graph will show the option position's total profit or loss (Y-axis) depending on the underlying price (x-axis). Here is an example: Call writer payoff diagram (video) - Khan Academy Call payoff diagram. Put payoff diagram. Put as insurance. Put-call parity. Long straddle. Put writer payoff diagrams. Call writer payoff diagram. This is the currently selected item. Arbitrage basics. ... For the owner of a call option with a $50 strike price, then the payoff at expiration ... we're talking about the value of that position. ... Payoff Diagrams for Options | Call Options | Put Options ... To Open your Demat & Trading account with Fyers Securities, Please click on below link Please fill in your details, Fyers rep...

Call Option Profit-Loss Diagrams - Fidelity Now let's look at a long call. Graph 2 shows the profit and loss of a call option with a strike price of 40 purchased for $1.50 per share, or in Wall Street lingo, "a 40 call purchased for 1.50." A quick comparison of graphs 1 and 2 shows the differences between a long stock and a long call. When buying a call, the worst case is that the share ... Ultimate Guide To The Long Call Option Strategy Long Call Option Examples The payoff diagram below is that of the $33 strike September 25th call that was trading for $1.18. Suppose an investor bought this call on September 14, 2020. Further, suppose that the investor's plan is to take profit if a 75% return on capital is achieved. Understanding Option Payoff Charts Option payoff diagrams are profit and loss charts that show the risk/reward profile of an option or combination of options. As option probability can be complex to understand, P&L graphs give an instant view of the risk/reward for certain trading ideas you might have. Short Call Option Payoff Graph: A Beginners Guide Call Option Payoff Graph Understanding payoff graphs (or diagrams as they are sometimes referred) is absolutely essential for option traders. A payoff graph will show the option position's total profit or loss (Y-axis) depending on the underlying price (x-axis). Here is an example:

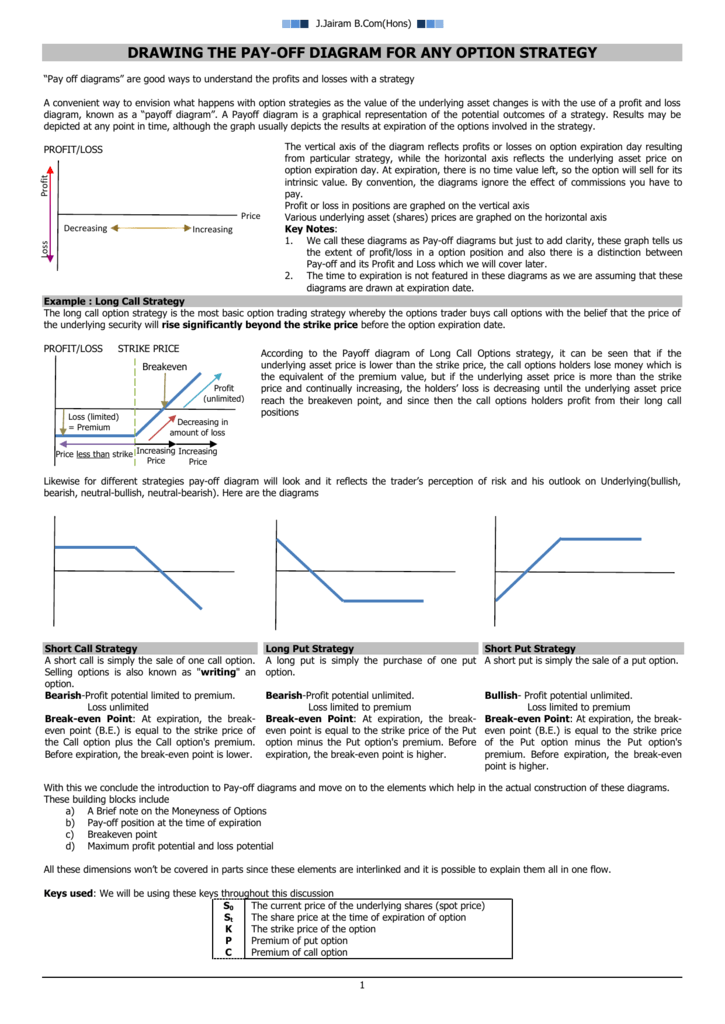

Derivatives: Pay off Diagram "payoff diagram". A Payoff diagram is a graphical representation of the potential outcomes of a strategy. Results may be depicted at any point in time, although the graph usually depicts the results at expiration of the options involved

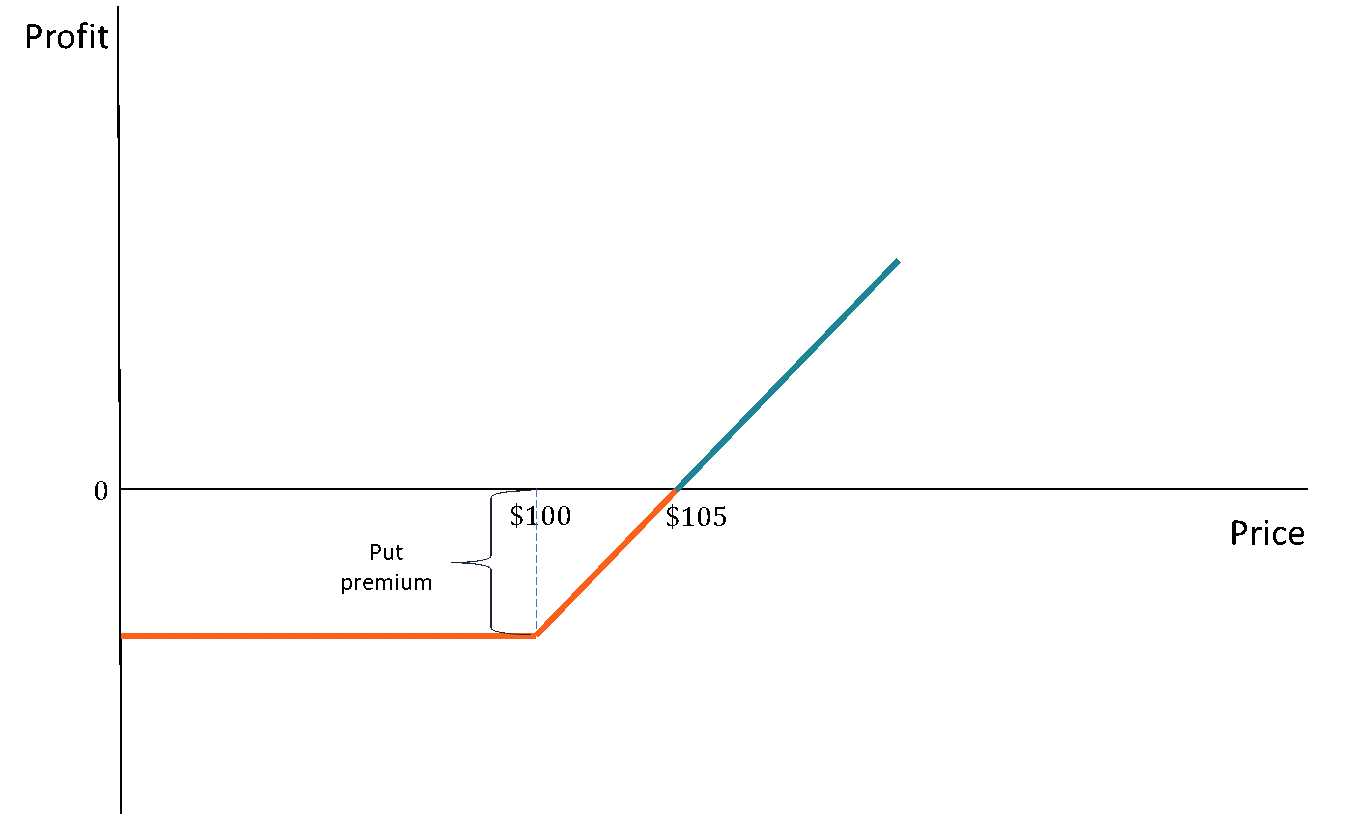

Put payoff diagram (video) - Khan Academy Put payoff diagram. Transcript. A put payoff diagram is a way of visualizing the value of a put option at expiration based on the value of the underlying stock. Learn how to create and interpret put payoff diagrams in this video. Created by Sal Khan.

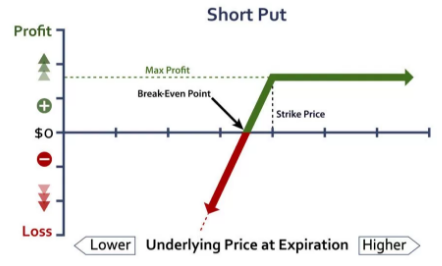

Put writer payoff diagrams (video) | Khan Academy It's worthless to have the option to sell something at fifty where you can just sell the actual stock in the open market or buy the stock at fifty. So then the put option becomes worthless for a stock price above that. Now, this is the payoff diagram. And this is when we just think about the value and expiration.

Option Payoff | Quantra by QuantInsti An option payoff diagram is a graphical representation of the net Profit/Loss made by the option buyers and sellers. where, S = Underlying Price. X = Strike Price. Break even point is that point at which you make no profit or no loss. Option Premium is the upfront payment made by the option buyer to the option seller to acquire the option.

Option Strategy Pay-Off Diagram Builder - Stockezee Option Strategy Pay-Off Diagram Builder | Stockezee. Zerodha (₹20/Trade) Open Account. Angel Broking Flat ₹20 per trade. Aliceblue Get 0% Commission. 5 Paisa ₹0 Account Opening.

Drawing Option Payoff Diagrams in Excel - Macroption This is part 5 of the Option Payoff Excel Tutorial, which will demonstrate how to draw an option strategy payoff diagram in Excel.. In the previous four parts we have explained option profit or loss calculations and created a spreadsheet that calculates aggregate P/L for option strategies involving up to four legs.For example, the screenshot below shows an iron condor made on strikes 45/50/55 ...

Put Option Payoff Diagram and Formula - Macroption As you can see in the diagram, a long put option's payoff is in the positive territory on the left side of the chart and the total profit increases as the underlying price goes down. The relationships is linear and the slope depends on position size.

Bull Call Spread Option Payoff Graph - Options Trading IQ Bull Call Spread Option Payoff Graph Understanding payoff graphs (or diagrams as they are sometimes referred) is absolutely essential for option traders. A payoff graph will show the option position's total profit or loss (Y-axis) depending on the underlying price (x-axis). Here is an example:

Payoff Graphs vs Profit & Loss Diagrams - Overview, Examples Payoff graphs are the graphical representation of an options payoff. They are often also referred to as "risk graphs." The x-axis represents the call or put stock option's spot price , whereas the y-axis represents the profit/loss that one reaps from the stock options. The payoff graph looks like the graph outline shown below:

Call payoff diagram | Finance & Capital Markets | Khan ... Call Payoff Diagram. Created by Sal Khan.Watch the next lesson: ...

Short Call Payoff Diagram and Formula - Macroption the option expires worthless or with intrinsic value lower than what you sold the option for. Short Call Payoff Diagram The payoff diagram of a short call position is the inverse of long call diagram, as you are taking the other side of the trade. Basically, you multiply the profit or loss by -1.

Binary Call Option Explained - The Options Guide Binary Call Option Payoff Diagram. Binary Call Option Example. A binary options brokerage is offering 85% payout for the binary call option on EUR/USD which is currently trading at $1.30. After tracking the price movement of EUR/USD for the past hour, the binary option trader believes that the price will rise over the next 5 minutes and decides ...

Call Option Payoff Diagram, Formula and Logic - Macroption Call Option Payoff Diagram Buying a call option is the simplest of option trades. A call option gives you the right, but not obligation, to buy the underlying security at the given strike price. Therefore a call option's intrinsic value or payoff at expiration depends on where the underlying price is relative to the call option's strike price.

Option Payoff Diagram Excel - Wiring Diagrams 1, Payoff Diagram on a Call Option. 2, Current Stock Price = $ 3, Strike Price of Option = $ 4, Price of the Option = $ 5. 6, Stock Price, Gross.

Call Option Payoff Graph - Options Trading IQ Call Option Payoff Graph Understanding payoff graphs (or diagrams as they are sometimes referred) is absolutely essential for option traders. A payoff graph will show the option position's total profit or loss (Y-axis) depending on the underlying price (x-axis). Here is an example:

:max_bytes(150000):strip_icc()/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

/dotdash_Final_Short_Put_Apr_2020-01-c4073b5f97b14c928f377948c05563ef.jpg)

0 Response to "42 call option payoff diagram"

Post a Comment