42 short call payoff diagram

Call payoff diagram | Finance & Capital Markets | Khan ... Call Payoff Diagram. Created by Sal Khan.Watch the next lesson: ... Short Call Payoff Diagram and Formula - Macroption The payoff diagram of a short call position is the inverse of long call diagram, as you are taking the other side of the trade. Basically, you multiply the profit or loss by -1. For detailed explanation of the logic behind individual sections of the graph, see long call option payoff. Short Call Payoff Formulas

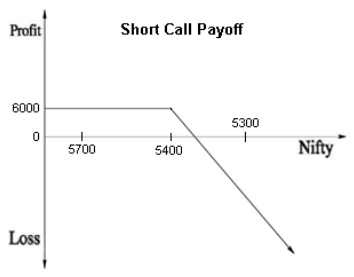

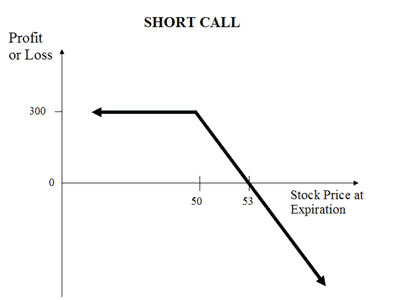

Understanding Option Payoff Charts Selling a Call Payoff. When we reverse the position and sell a call option, here is the payoff diagram for that. We have the same format of stock price on the x-axis (horizontal) and P&L on the y-axis (vertical). Because we sold the call, we receive money for the sale, which is the premium.

/dotdash_Final_Call_Apr_2020-02-cf56d3cf2d424ade8f6001fa23883a3c.jpg)

Short call payoff diagram

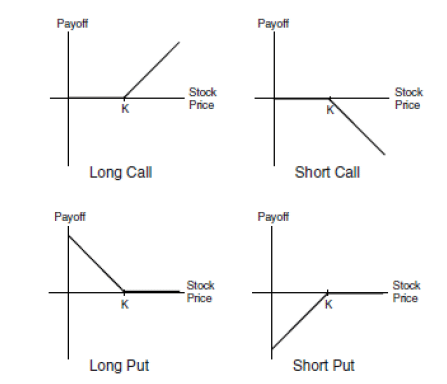

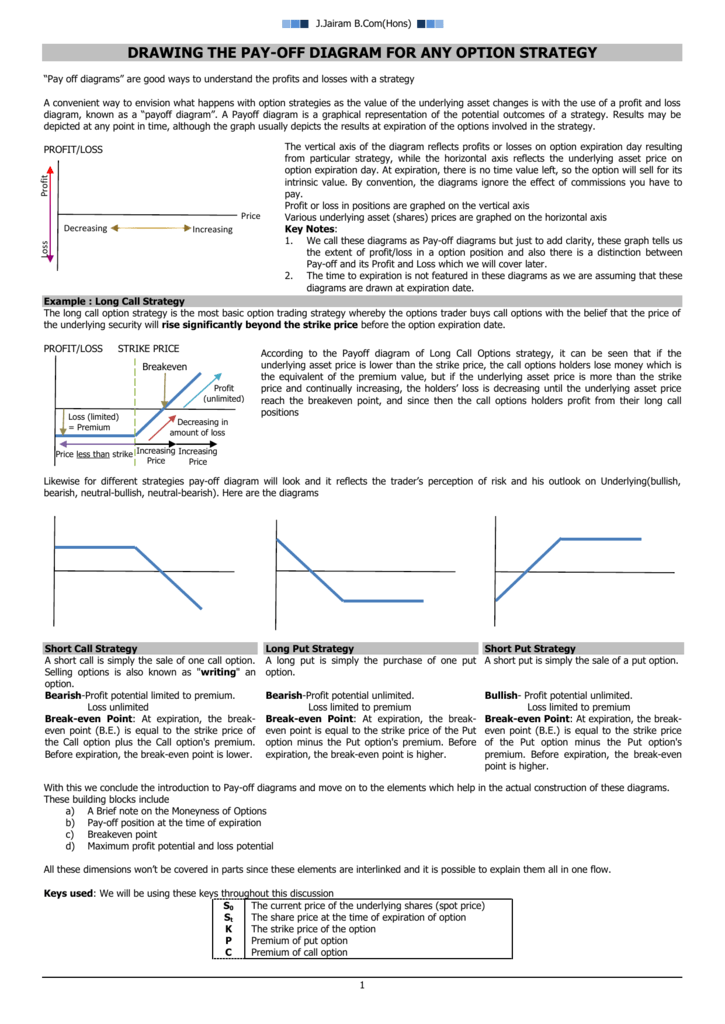

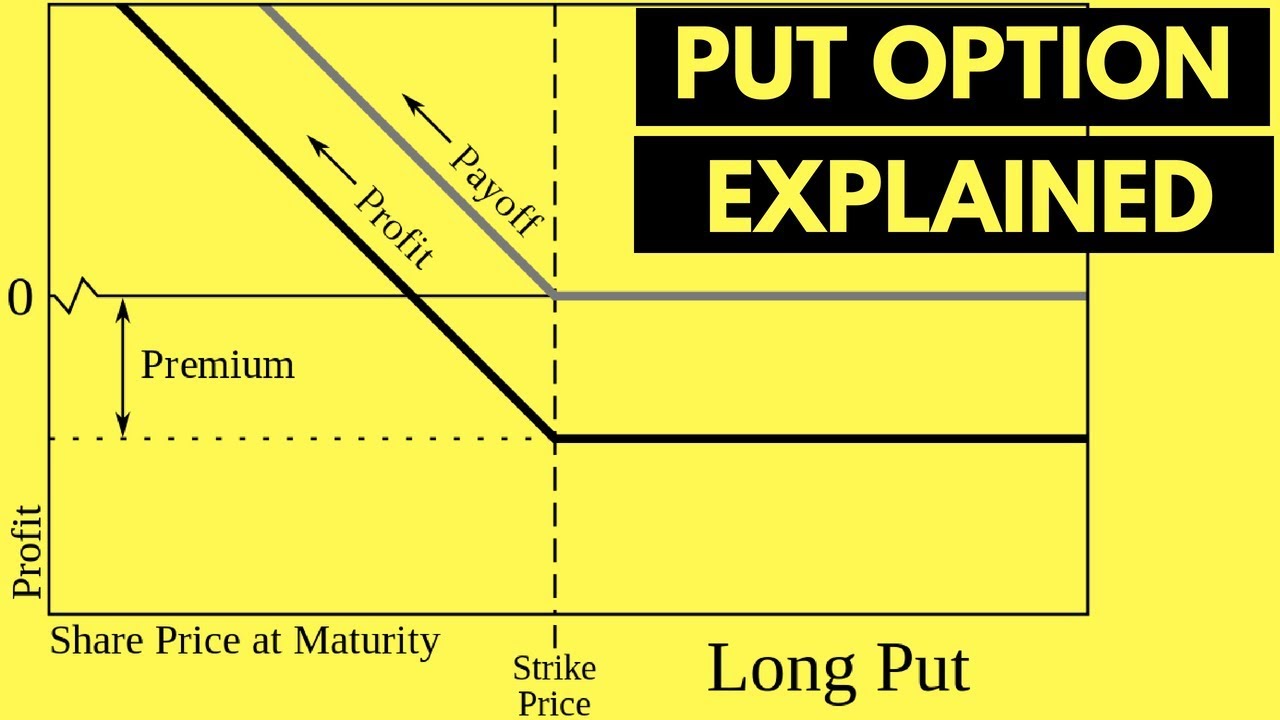

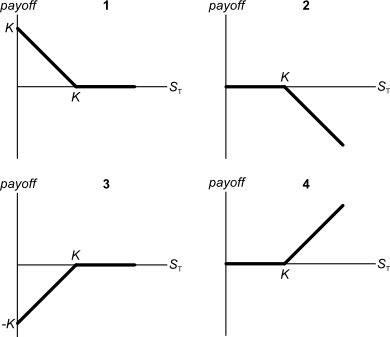

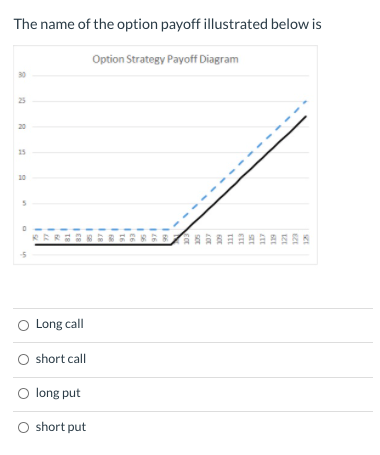

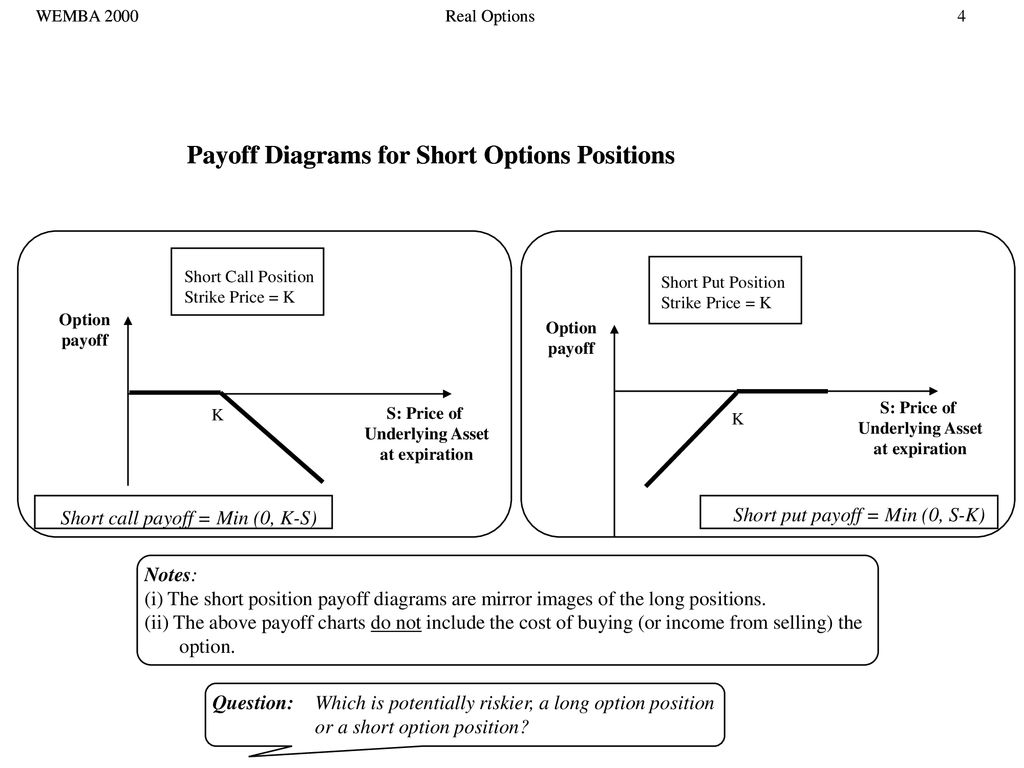

Payoff Graphs vs Profit & Loss Diagrams - Overview, Examples Payoff graphs are the graphical representation of an options payoff. They are often also referred to as "risk graphs." The x-axis represents the call or put stock option's spot price , whereas the y-axis represents the profit/loss that one reaps from the stock options. The payoff graph looks like the graph outline shown below: Short put formula and payoff explained. Put option graph ... Short put: sellers of put options hope the stock price to go up or stay around current levels.If the asset price decreases, options sellers are obliged to buy shares at a predetermined price (strike). A seller of a put option receives a premium, that is, the profit potential is limited and known in advance, while risks are conditionally unlimited. Put payoff diagram (video) - Khan Academy Put payoff diagram. Transcript. A put payoff diagram is a way of visualizing the value of a put option at expiration based on the value of the underlying stock. Learn how to create and interpret put payoff diagrams in this video. Created by Sal Khan.

Short call payoff diagram. Payoff Diagram for one long &one short position in Call ... 1) Portfolio 1 break-even. Draw the gross and net payoff diagrams for a portfolio which is constructed from buying one call option with a strike price $45.00 and selling one call option with a strike price of $50. The cost of the first option of $7.75 and the cost of the second option is $3.50. › put-option-payoffPut Option Payoff Diagram and Formula - Macroption This page explains put option profit/loss at expiration, payoff diagram, and break-even calculation. If you have seen the page explaining call option payoff, you will find the overall logic is very similar with puts; there are just a few differences which we will point out. See also short put payoff (inverse position). Options Payoffs and Profits (Calculations ... - AnalystPrep The payoff to the put buyer: pT = M ax(0,X -ST) = M ax(0,$26-$29) = 0 p T = M a x ( 0, X - S T) = M a x ( 0, $ 26 - $ 29) = 0. When the option has a positive payoff, it is said to be in the money. In the example above, the call option is in the money. The put option is out of the money because X -ST X - S T is less than 0. optionstradingiq.com › short-strangle-strategyShort Strangle Strategy: Ultimate Guide For 2021 Oct 28, 2020 · Short strangles have a payoff diagram shown with a dashed line in the graph of the SPY trade. The trade has high gamma, particularly when it approaches expiration. The ideal scenario for short strangles is when the price of the underlying stock trades in a narrow range between the breakeven points with decreasing volatility.

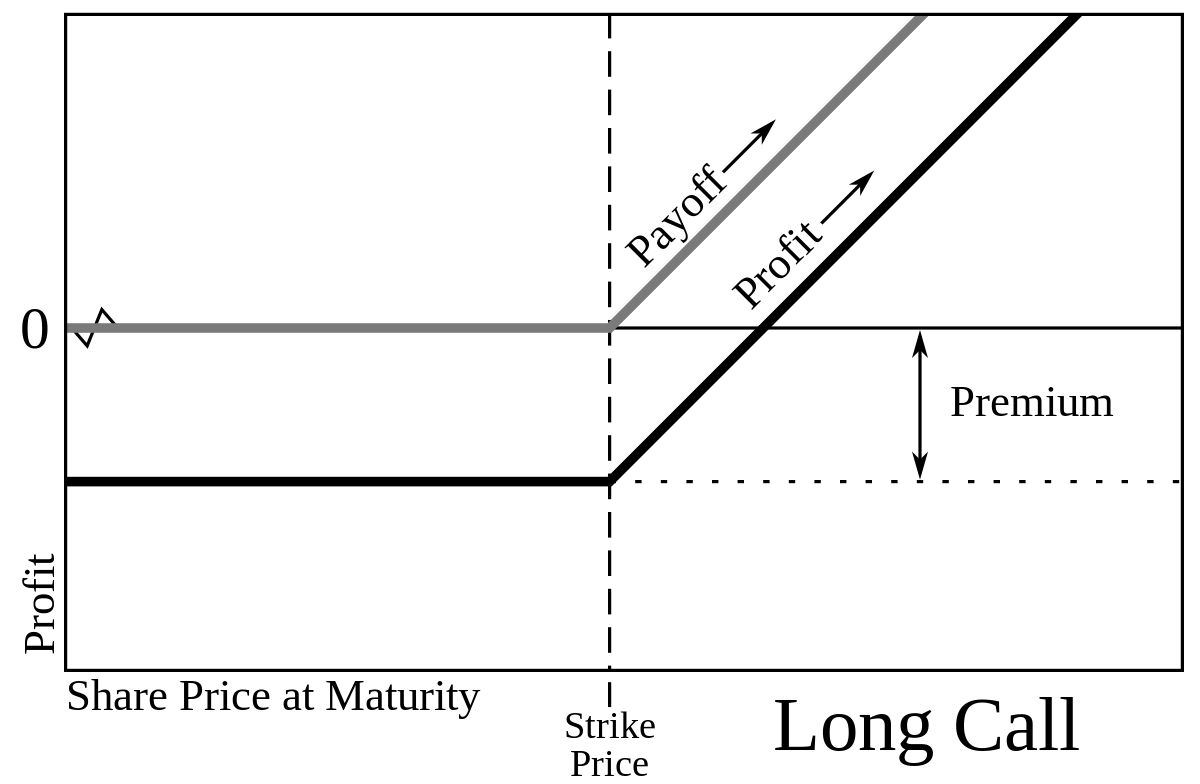

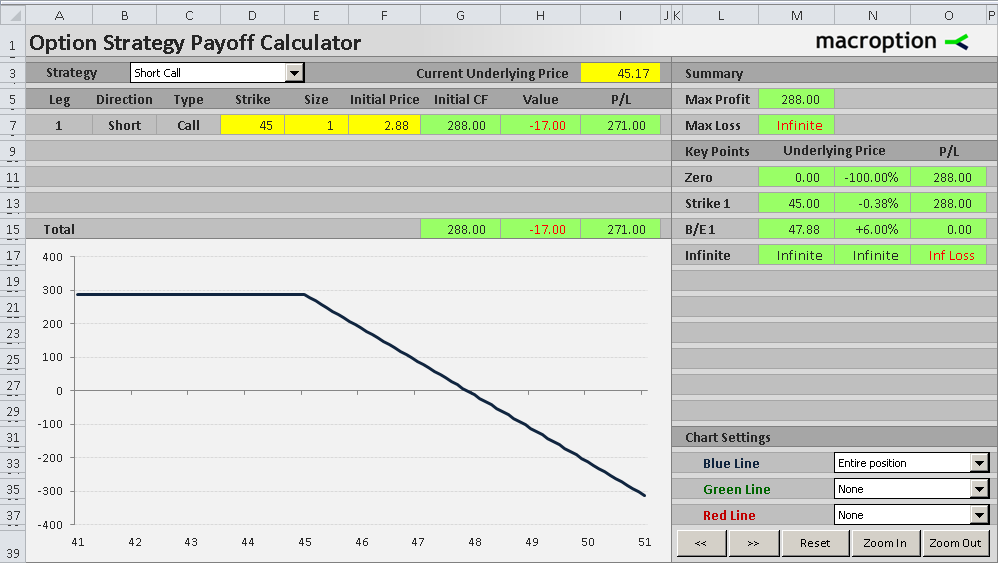

Call Option Payoff Diagram, Formula and Logic - Macroption The payoff diagram shows how the option's total profit or loss (Y-axis) depends on underlying price (X-axis). The key variables are: Strike price (45 in the example above) Initial price at which you have bought the option (2.88 in the example) Current underlying price (the chart's X-axis) Short Call (Naked Call) Option Strategy Explained Short Call (or Naked Call) strategy involves the selling of the Call Options (or writing call option). In this strategy, a trader is Very Bearish in his market view and expects the price of the underlying asset to go down in near future. ... Your pay-off diagram is much superior to the ones usually available.I suggest if a relevant price chart ... Short Call - Overview, Profits, Advantages and Disadvantages A short call is an options strategy where an investor writes (sells) a call option on a stock because he expects that stock's price to decrease in the future. Understanding the Short Call Strategy. The short call strategy creates a contract between the option writer (seller) and the option buyer (holder). Short Call Definition - investopedia.com A short call is a strategy involving a call option, giving a trader the right, but not the obligation, to sell a security. It usually reflects a bearish outlook: an assumption that the price of ...

thefinancebuff.com › short-box-spread-vs-marginShort Box Spread Trade vs Margin Loan: How It Works at Fidelity Feb 02, 2022 · Iron Condor is different. Though it also involves 4 options, 2 long, 2 short. But the strike pattern and payoff diagram are different! You will likely get a lower rate than a mortgage and the interest is tax-deductible! So, this box trade is a really neat tool! Go, Giants! Short Call Strategy Guide [Setup, Entry, Adjustments, Exit] Short Call Payoff Diagram The payoff diagram for a short call represents the risk involved with selling naked options. Profit potential is limited to the amount of credit received when the call is sold. However, the risk is unlimited if the underlying asset experiences an increase in price. Call payoff diagram (video) - Khan Academy A call payoff diagram is a way of visualizing the value of a call option at expiration based on the value of the underlying stock. Learn how to create and interpret call payoff diagrams in this video. Created by Sal Khan. Google Classroom Facebook Twitter Email Sort by: Tips & Thanks Video transcript PDF CHAPTER 21 . OPTIONS - University of Houston (4) Buy call, short sell stock, and lend the present value of the exercise price 3. Using Put-Call Parity to value puts → Payoff from buying put = Payoff from buying call + Payoff from short selling stock, + Payoff from lending the present value of the exercise price → P0 = C0 - S0 + E * e-r f ×t

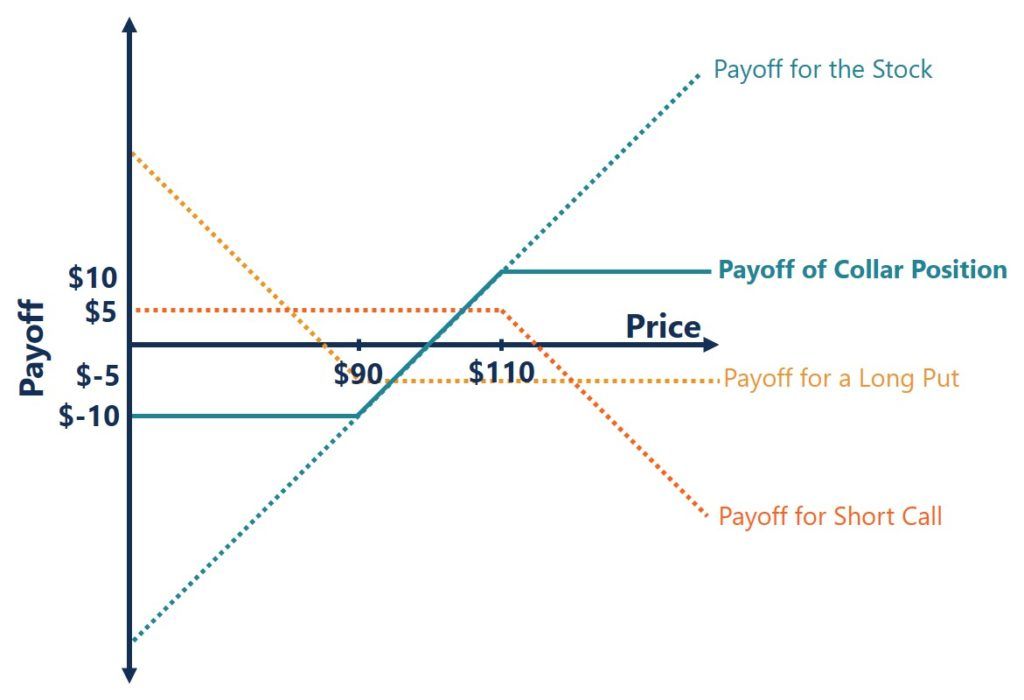

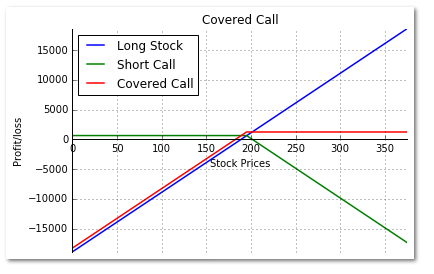

Options Collar Guide [Setup, Entry, Adjustments, Exit] Collar Payoff Diagram The collar strategy payoff diagram has a defined maximum profit and loss. Shares of the underlying asset may be sold at the short call strike price or the long put strike price if the option is in-the-money at expiration. If the stock is between the two levels at expiration, both the call and put options will expire worthless.

Short Call Options Strategy (Awesome Guide w/ Examples) Payoff Diagram Short calls have a similar shaped payoff diagram to a long put. Profits are flat below the strike price with a breakeven price equal to the strike price plus the premium. Above the breakeven price, losses accrue on a one to one basis with a move higher in the stock price.

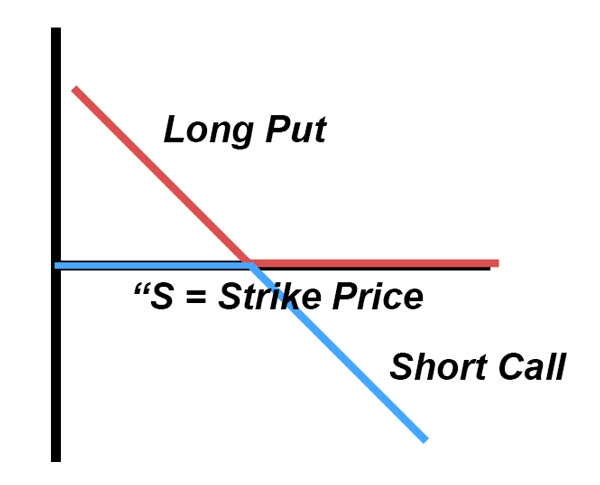

› synthetic-short-stockSynthetic Short Stock Explained | Online Option Trading Guide The synthetic short stock is an options strategy used to simulate the payoff of a short stock position. It is entered by selling at-the-money calls and buying an equal number of at-the-money puts of the same underlying stock and expiration date.

Payoff and profit profile of a long call and short put ... Download scientific diagram | Payoff and profit profile of a long call and short put from publication: Valuing put options on single stock futures: Does the put-call parity relationship hold in ...

Short Call Option Payoff Graph: A Beginners Guide What we are looking at here is the payoff graph for a short call option strategy. In this example the trader has sold a 345 strike call for $4 per contract (or $400 for a standard option contract representing 100 shares). The premium collected of $400 is the most the trade can profit. That occurs at an underlying stock price of $345 and below.

Synthetic Short Call Explained | Online Option Trading Guide Synthetic Short Call Payoff Diagram 0.00% Commissions Option Trading! Trade options FREE For 60 Days when you Open a New OptionsHouse Account Unlimited Risk The formula for calculating loss is given below: Maximum Loss = Unlimited Loss Occurs When Price of Underlying > Sale Price of Underlying + Premium Received

Short Condor Explained | Online Option Trading Guide Max Profit Achieved When Price of Underlying = Strike Price of Lower Strike Short Call OR Price of Underlying >= Strike Price of Higher Strike Short Call. Short Condor Payoff Diagram. 0.00% Commissions Option Trading! Trade options FREE For 60 Days when you Open a New OptionsHouse Account.

Payoff diagrams | A Matter of Course - WordPress.com Payoff diagrams are simply diagrammatic representation of payoffs at termination/expiration of a contract w.r.t value of the underlying . For example, for a baker's forward contract (long forward) it is a plot of its payoff () at expiration () w.r.t the wheat's spot price .

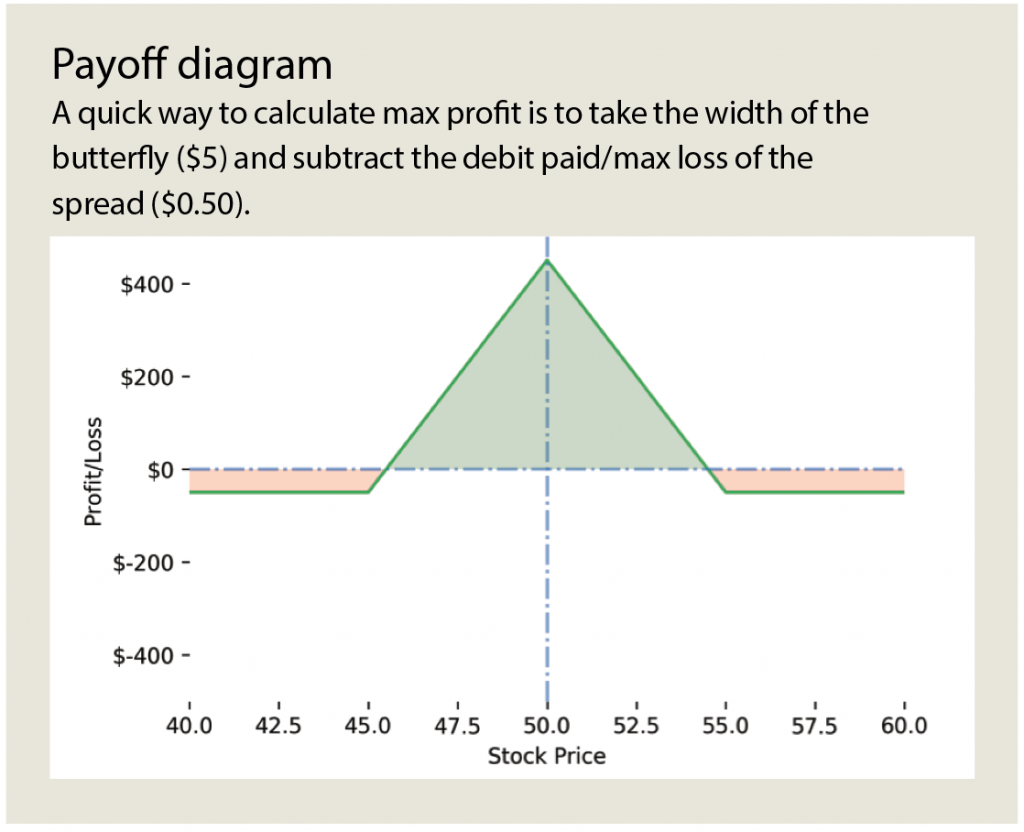

Straddles, Butterflies, Iron Condors and More Below we give an example of buying and selling both calls and puts and show the resulting payoff diagram. obj = OptionStrat('Custom', 100) obj.long_call(120,2, 1) obj.long_call(100,4 , 7) obj.short_call(150,0.75,3) obj.long_put(80, 2, 4) obj.short_put(40, 0.65, 10) obj.plot(color='black')

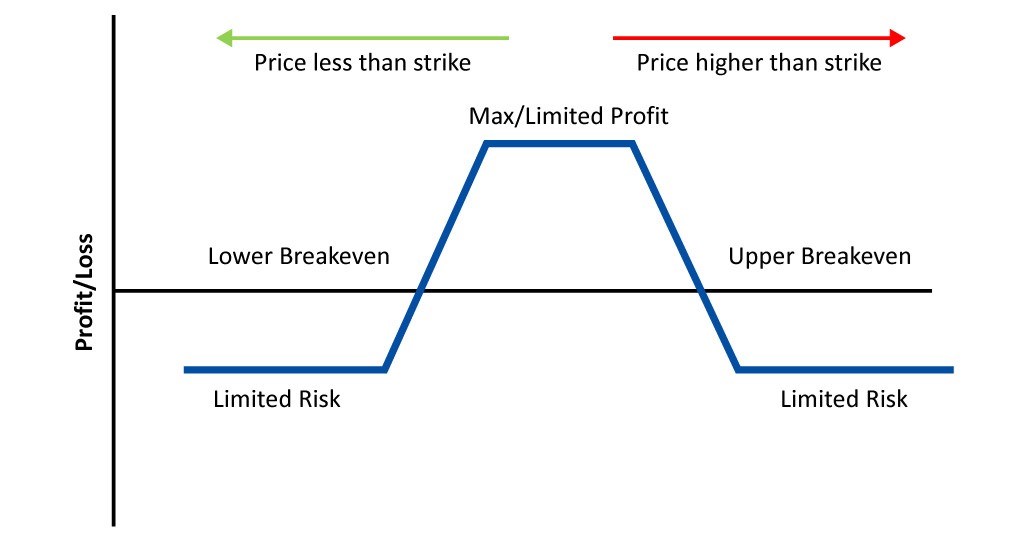

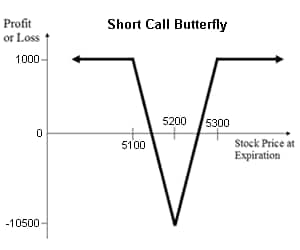

en.wikipedia.org › wiki › Butterfly_(options)Butterfly (options) - Wikipedia A short butterfly position will make profit if the future volatility is higher than the implied volatility. A short butterfly options strategy consists of the same options as a long butterfly. However now the middle strike option position is a long position and the upper and lower strike option positions are short. Margin requirements

en.wikipedia.org › wiki › StraddleStraddle - Wikipedia The short straddle can also be classified as a credit spread because the sale of the short straddle results in a credit of the premiums of the put and call. The risk to a holder of a short straddle position is unlimited due to the sale of the call and the put options which expose the investor to unlimited losses (on the call) or losses limited ...

Derivatives: Pay off Diagram "payoff diagram". A Payoff diagram is a graphical representation of the potential outcomes of a strategy. Results may be depicted at any point in time, although the graph usually depicts the results at expiration of the options involved

Solved Draw a payoff diagram of a portfolio consisting of ... Draw a payoff diagram of a portfolio consisting of a long call with strike price K and a short call with strike price K' > K (both written on the same underlying stock). Is the cost of the portfolio positive, negative, or zero? Explain. Draw a diagram showing the profit of the portfolio as a function of the underlying stock.

Short Straddle - Fidelity Net credit =. 6.50. A short straddle consists of one short call and one short put. Both options have the same underlying stock, the same strike price and the same expiration date. A short straddle is established for a net credit (or net receipt) and profits if the underlying stock trades in a narrow range between the break-even points.

Payoff Diagrams for Options | Call Options | Put Options ... Payoff Diagrams for Options | Call Options | Put Options | Options Long | Short | How to Read Payoff Diagram Hi This is Ashish yadav Welcome to my Channel -...

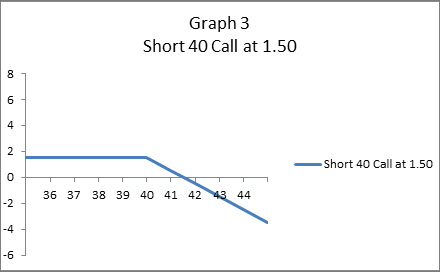

Call Option Profit-Loss Diagrams - Fidelity Above 41.50, or to its right on the diagram, the long call earns a profit. Note that the diagram is drawn on a per-share basis and commissions are not included. Graphing a short call. Now for the third example—a short call. Graph 3 shows the profit and loss of selling a call with a strike price of 40 for $1.50 per share, or in Wall Street ...

Put payoff diagram (video) - Khan Academy Put payoff diagram. Transcript. A put payoff diagram is a way of visualizing the value of a put option at expiration based on the value of the underlying stock. Learn how to create and interpret put payoff diagrams in this video. Created by Sal Khan.

Short put formula and payoff explained. Put option graph ... Short put: sellers of put options hope the stock price to go up or stay around current levels.If the asset price decreases, options sellers are obliged to buy shares at a predetermined price (strike). A seller of a put option receives a premium, that is, the profit potential is limited and known in advance, while risks are conditionally unlimited.

Payoff Graphs vs Profit & Loss Diagrams - Overview, Examples Payoff graphs are the graphical representation of an options payoff. They are often also referred to as "risk graphs." The x-axis represents the call or put stock option's spot price , whereas the y-axis represents the profit/loss that one reaps from the stock options. The payoff graph looks like the graph outline shown below:

/dotdash_Final_Call_Apr_2020-02-cf56d3cf2d424ade8f6001fa23883a3c.jpg)

0 Response to "42 short call payoff diagram"

Post a Comment